As we look towards 2025, the US insurance market is poised for significant transformation driven by technological advancements, changing consumer expectations, and macroeconomic factors. Here are the essential trends and data that will shape the industry:

-

Widening Protection Gap

The global protection gap—the difference between actual and insured losses—is expected to widen, reaching approximately $1.86 trillion by 2025, with the Asia-Pacific region accounting for nearly half of this gap. This presents both challenges and opportunities for insurers to innovate and reach underinsured customers effectively.

-

Digital Transformation and AI Integration

The insurance industry is increasingly adopting digital technologies and artificial intelligence (AI) to enhance customer interactions across various stages including product design, underwriting, pricing, and claims processing. Innovations such as bionic advisers, which blend human and digital experiences, are becoming more prevalent. Insurers that embrace these technologies early will likely gain a competitive edge in the market.

-

Shifts in Consumer Expectations

There is a notable shift from a “Promise to Pay” model to a “Promise to Help” approach. This change reflects a growing demand for insurers to provide more proactive support to policyholders, particularly in times of crisis. Insurers will need to adapt their strategies to meet evolving customer needs.

-

Market Concentration and Rising Costs

The health insurance market is becoming increasingly concentrated, with fewer companies dominating the market share. This trend could lead to higher premiums and reduced competition, affecting consumer access to affordable coverage. Experts predict that these dynamics will contribute to rising insurance costs in 2025.

-

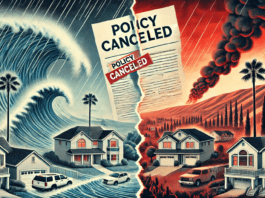

Sustainability and Climate Risk

Insurers are facing increasing demands regarding climate risk management and sustainability practices. As environmental concerns grow, companies will need to integrate sustainable practices into their operations while also addressing the risks associated with climate change.

-

Profitability Trends

Despite challenges such as inflation and economic uncertainty, profitability in the insurance sector is expected to improve. Estimates suggest that insurers’ return on equity could rise to about 10.7% in 2025, with non-life sector combined ratios decreasing due to lower claims costs. However, emerging risks may present new growth opportunities for insurers.

-

Regulatory Changes and Economic Factors

Macroeconomic conditions such as inflation rates and employment levels will significantly influence the insurance landscape. For instance, rising unemployment rates may affect group insurance sales, while inflation could impact premium pricing strategies.

The US insurance market in 2025 will be characterized by a blend of technological innovation, shifting consumer expectations, regulatory changes, and macroeconomic influences. Insurers must navigate these trends strategically to enhance operational efficiency and customer engagement while addressing the widening protection gap and increasing market concentration challenges.