As 2025 approaches, property owners face a dynamic landscape in the home insurance market. Understanding these insurance trends is essential to protect assets and manage costs effectively. This article analyzes key factors shaping the industry, highlights their implications for policyholders, and suggests proactive measures.

Continued Home Insurance Premium Increases

Home insurance premiums are expected to keep rising, though at a slower pace. Forecasts indicate increases between 6.6% and 15% or more, depending on location and risk profile. Natural disaster-prone regions, such as the Southeastern United States, may face higher rate hikes.

Reviewing your policy and negotiating terms with your insurer can help secure better rates before further increases.

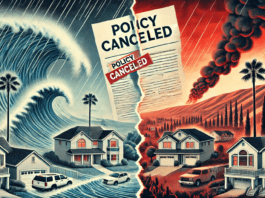

Climate and Weather Risks

Severe weather events like hurricanes and wildfires will continue impacting the market. These disasters can cause sudden premium hikes and limit coverage availability in high-risk areas.

Consider exploring alternative coverage options through the excess and surplus (E&S) market, which offers specialized policies, though often at a higher cost.

Regulatory Pressures

State regulations will remain critical in determining insurance rates. States like California and New Jersey are likely to impose stricter limits on premium adjustments, constraining insurers’ ability to set rates.

Staying informed about local regulatory changes can help you anticipate how they may affect your policy renewal.

Market Stabilization and Carrier Re-entry

The good news is that some major insurers are returning to previously restricted states, increasing competition and expanding coverage options. This could result in more competitive rates and broader policies.

Requesting multiple quotes when renewing your policy can help you take advantage of the increased competition.

Coverage Adjustments and Exclusions

Coverage terms are expected to change. For example, some insurers may shift from replacement cost to actual cash value (ACV) for roof coverage, limiting claim payouts. Flood insurance could remain mandatory in flood-prone areas.

Carefully reviewing your policy terms and considering supplemental coverage can help ensure adequate protection.

Economic Factors

With inflation slowing, repair and claim costs may stabilize. However, broader economic conditions and insurers’ investment performance will still influence premium rates.

Monitoring economic indicators and adjusting your coverage accordingly can help you stay prepared.

Bundling and Market Competition

Many insurers promote policy bundling for home and auto insurance to spread risk and boost profitability. While this can offer savings, it’s not always the most cost-effective option.

Comparing standalone and bundled policies ensures you get the best deal.

Technology and Alternative Solutions

Emerging solutions like parametric insurance are gaining popularity. These policies offer quick payouts based on predefined disaster triggers, providing immediate financial relief.

Asking your insurer about parametric insurance can help determine whether it’s a suitable add-on for your home.

Final Considerations

Understanding home insurance trends can save you money and ensure adequate protection for your property. Anticipating market changes, reviewing your insurance coverage, and exploring new solutions are crucial strategies for 2025. Start evaluating your coverage now to secure the best protection and rates available!